- Production: 100%

- Developer Portal: 100%

- Sandbox: 100%

The sandbox is a mocked environment which allows you to test your application. This environment simulates API responses of the requests described in API page of this developer portal.

To get a response the request has to match certain headers, path and query parameters with specific values described below. Any deviation in these parameters may return in an error code.

The endpoints used in the sandbox environment are identical as those used in production.

You will need to have a valid QWAC Certificate for PSD2 in order to perform the requests on the sandbox. This certificate is mandatory; otherwise you will get an error. The sandbox is freely accessible and you don't need to fulfil an enrolment process to use it

All the specified values to use for the requests will be described in the next paragraphs.

For more details, please refer to the HowTo Manage Consents for Account Information Service

You can create a consent which will create implicitly an authorisation on this consent by setting the header “TPP-Explicit-Authorisation-Preferred” of this request to “false”. In this case, the creation of another authorisation on the consent will be forbidden and you will just have to authorise the consent using the link in the response.

Use the value “VALID_CONSENT_ID” in the request path to test this API.

Here is an example of a body that you can use to test the request:

{

"access": {

"allPsd2": "allAccounts"

},

"recurringIndicator": true,

"frequencyPerDay": 4,

"combinedServiceIndicator": false,

"validUntil": "2030-12-12"

}

If the header “TPP-Explicit-Authorisation-Preferred” is set to true you will have to create manually an authorisation on the consent with the following request in order get the authorize link:

Use the value “CONSENT_ID_NO_AUTHORIZATION” in the request path to test this API.

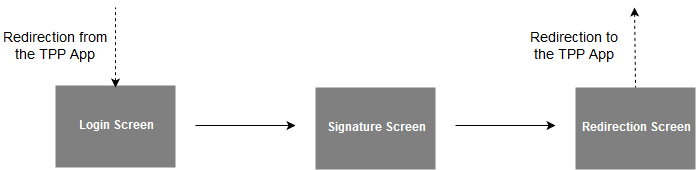

The authorisation workflow implements the BerlinGroup redirect scenario using OAuth2 SCA Protocol.

In order to test this redirect approach, the sandbox provides a graphical user interface in order to simulate all the possible SCA scenarios (Login fails, timeout, SCA rejected…) that are listed below:

| SCA scenario | Description |

|---|---|

| LOGIN_CANCEL | If the login phase was cancelled by the PSU |

| LOGIN_TIMEOUT | If the login phase encountered a timeout |

| LOGIN_OTHER_ERROR | If another error occurred during the login phase |

| LOGIN_REQUEST_REJECTED | If the login phase was rejected |

| BAD_PASSWORD_LOGIN | If an error occurred during the login phase with a bad password |

| UNKNOWN_LOGIN | If an error occurred during the login phase with an unknown login |

| SCA_OK | To get a successful authorisation |

| SCA_EXEMPTED | If the SCA phase was exempted |

| SCA_CANCEL | If the SCA phase was cancelled by the PSU |

| SCA_TIMEOUT | If the SCA phase encountered a timeout |

| SCA_OTHER_ERROR | If another error occurred during the SCA phase |

| SCA_NOK | If the SCA phase did not succeed |

| SCA_REQUEST_REJECTED | If the SCA phase was rejected |

| SCA_INTERNAL_ERROR | If an internal error occurred |

To access this graphical user interface you have to build your authorisation URI using the scaOAuth URL received in the response of the consent initialisation with the following parameters:

| URI parameter | Sandbox value | Comments |

|---|---|---|

| scope | AIS:VALID_CONSENT_ID | Must be set to this value on the Sandbox. On the production API, Must be set to this the consentId returned by the consent initialisation |

| client_id | VALID_CLIENT_ID | Must be set to this value on the Sandbox. On Production API, you must provide your NCA id |

| state | Any value | On Production API, this is a dynamical value that you have to set in order to prevent XSRF attacks |

| redirect_uri | Any URI value | On Production API, this corresponds to the URI where the OAuth2 server is redirecting the PSU after the authorization |

| code_challenge | Any value | On Production API, this corresponds to PKCE challenge according to cryptographic RFC 7636 (https://tools.ietf.org/html/rfc7636) and is used to prevent code injection attacks |

| response_type | code | Must be set to this value on the Sandbox and on Production API |

| code_challenge_method | S256 | On Production API this parameter is optionnal and corresponds to the code verifier transformation method ("S256" or "plain") |

Following these instructions, you should build the following URI for the sandbox:

This URI will redirect on a mocked page on which you can test the different redirect scenarios of the authorisation flow. All user flow will display an information page before redirecting the PSU to the redirect_uri (HTTP 302 response).

In order to access the PSD2 requests you need to get an access token for your application. To get this token you have to exchange an authorization_code with a valid token. This authorization_code is found in the 302 response of a valid authorisation.

First of all, you have to use for this request a body encoded as x-www-form-urlencoded.

Here are the specific keys to use for the body of this request: (cf. API /token in API section)

"authorization_code" as value for the "grant_type" parameter

"VALID_CLIENT_ID" as value for the "client_id" parameter

"Any value" as value for the "code_verifier" parameter (On production environment, you have to use the code_verifier of code_challenge provided in the authorize URL)

the following values for the "code" parameter:

| Code | Description |

|---|---|

| AIS_VALID_CODE | Valid code to get an access token for the consent VALID_CONSENT_ID |

| AIS_VALID_CODE_TRANSACTION_90D_KO | Valid code to get an access token for the consent CONSENT_ID_TRANSACTION_90D_KO. This consent is to used in order to get the error of the access right to transactions older than 90 days |

The response to this API comes in the form of a JSON object with the following structure:

{

"access_token": "4db39597dc674268a7fa253d255c47cec7618d14ebdd433a984a7680ce0b77ad0bd76a3a55e8455b980bf41c833a03ce",

"token_type": "Bearer",

"expires_in": 3600,

"refresh_token": "e3da5c9922a34d6e8fa0fa4b780acc2c1ad3a05d485f43f08580250d26a1782b0544973a64204185a9257ca07143c0bb",

"scope": "AIS:VALID_CONSENT_ID"

}

This will be the access that has a limited time validity that you have to use for the future request.

According to Oauth2 specification, you can exchange this access token for a refresh token still using the /Token API but with a “refresh_token” as grant type in the body of the request:

| Parameter | Value |

|---|---|

| grant_type | refresh_token |

| refresh_token | The refresh token that you just got with the /token API |

| client_id | VALID_CLIENT_ID |

The refresh token will have a validity of 180 days, the duration of an AIS consent.

Here are the different consent ids that you can use to test these APIs.

| Consent Id | Description |

|---|---|

| VALID_CONSENT_ID | To retrieve a consent with the status “Valid” and a preselected scope |

| CONSENT_ID_REVOKED_BY_PSU | To retrieve a consent with the status “revokedByPsu” |

| CONSENT_ID_EXPIRED | To retrieve a consent with the status “expired” |

| CONSENT_ID_REJECTED | To retrieve a consent with the status “rejected” |

| CONSENT_ID_TERMINATED_BY_TPP | To retrieve a consent with the status “terminatedByTpp” |

| CONSENT_ID_RECEIVED | To retrieve a consent with the status “received” |

| CONSENT_ID_ALL_PSD2 | To retrieve a consent with the status “Valid” and a “allPsd2” scope |

| CONSENT_ID_AVAILABLE_ACCOUNTS | To retrieve a consent with the status “Valid” and a “availableAccounts” scope |

| CONSENT_ID_AVAILABLE_ACCOUNTS_WITH_BALANCES | To retrieve a consent with the status “Valid” and a “availableAccountsWithBalances” scope |

Here are the different consent ids that you can use to test this API.

| Consent Id |

|---|

| VALID_CONSENT_ID |

| CONSENT_ID_REVOKED_BY_PSU |

| CONSENT_ID_EXPIRED |

| CONSENT_ID_REJECTED |

| CONSENT_ID_TERMINATED_BY_TPP |

| CONSENT_ID_RECEIVED |

This request retrieves the list of the authorisations of the consent.

You can use the value “VALID_CONSENT_ID” in the request to test this API. If you use another value, the consent will be considered as not found.

You can use the value “VALID_CONSENT_ID” and a value for the “consentAuthorisationId” in the request path to test this API. If you use another value, the consent will be considered as not found.

| consentAuthorisationId | Description |

|---|---|

| 11111111-1111-1111-1111-111111111111 | To retrieve an authorisation with the status “finalised” |

| 22222222-2222-2222-2222-222222222222 | To retrieve an authorisation with the status “received” |

| 33333333-3333-3333-3333-333333333333 | To retrieve an authorisation with the status “psuIdentified” |

| 44444444-4444-4444-4444-444444444444 | To retrieve an authorisation with the status “psuAuthenticated” |

| 55555555-5555-5555-5555-555555555555 | To retrieve an authorisation with the status “scaMethodSelected” |

| 66666666-6666-6666-6666-666666666666 | To retrieve a authorisation with the status “started” |

| 77777777-7777-7777-7777-777777777777 | To retrieve an authorisation with the status “failed” |

| 88888888-8888-8888-8888-888888888888 | To retrieve an authorisation with the status “exempted” |

For more details, please refer to the HowTo Access Account Information Services

Here are the different consent ids that you can use to in the “Consent-Id” header to test this API.

You also have to use the access token for the corresponding status.

| Consent-Id (header) | Description |

|---|---|

| VALID_CONSENT_ID | Valid consent |

You have a limited access of 4 times per day to this API. You have to include the IP address from which the PSU accesses the TPP service in the PSU-IP-Address header in order not to apply the restriction.

Here are the different consent ids that you can use to in the “Consent-Id” header to test this API.

You also have to use the access token for the corresponding status.

| Consent-Id (header) | Account Id (request parameter) | Description |

|---|---|---|

| VALID_CONSENT_ID | ACCOUNT_ID | Account of a valid consent |

| VALID_CONSENT_ID | Any unknown account | No permission on this account |

You have a limited access of 4 times per day to this API. You have to include the IP address from which the PSU accesses the TPP service in the PSU-IP-Address header in order not to apply the restriction.

Here are the different consent ids that you can use to in the “Consent-Id” header to test this API.

You also have to use the access token for the corresponding status.

| Consent-Id (header) | Account Id (request parameter) | Description |

|---|---|---|

| VALID_CONSENT_ID | ACCOUNT_ID | Account of a valid consent |

| VALID_CONSENT_ID | Any unknown account | No permission on this account |

You have a limited access of 4 times per day to this API. You have to include the IP address from which the PSU accesses the TPP service in the PSU-IP-Address header in order not to apply the restriction.

Here are the different parameters that you can use to test this API.

You also have to use the access token for the corresponding consent.

| Consent-Id (header) | Account Id (request parameter) | Description |

|---|---|---|

| VALID_CONSENT_ID | ACCOUNT_ID | Account of a valid consent |

| VALID_CONSENT_ID | Any unknown account | No permission on this account |

| CONSENT_ID_TRANSACTION_90D_KO | ACCOUNT_ID | Account where the access right to transactions older than 90 days is expired |

You have a limited access of 4 times per day to this API. You have to include the IP address from which the PSU accesses the TPP service in the PSU-IP-Address header in order not to apply the restriction.

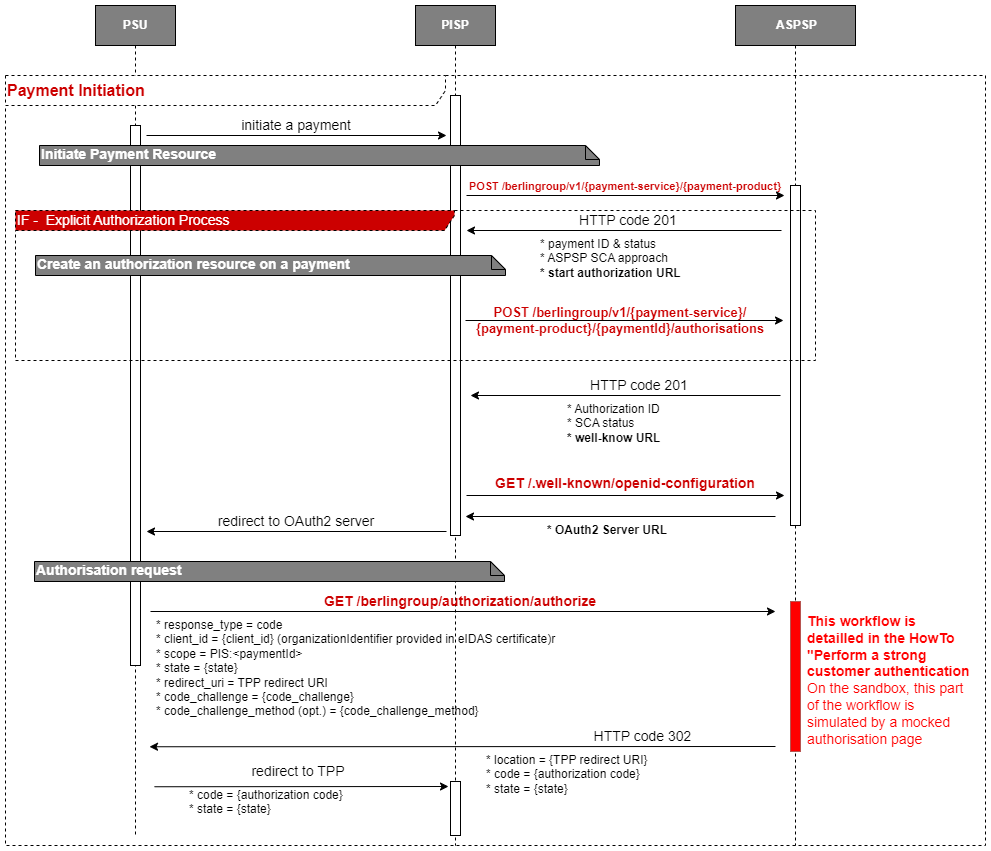

For more details, please refer to the HowTo Initiate a Payment and Manage payments information and status

Here are the different combinations that you can use in the URL of this request:

| Payment service | Payment product |

|---|---|

| payments | sepa-credit-transfers |

| cross-border-payments | |

| target2-payments | |

| bulk-payments | sepa-credit-transfers |

| cross-border-payments | |

| target2-payments |

You can create a payment which will create implicitly an authorisation on this payment by setting the header “TPP-Explicit-Authorisation-Preferred” of this request to “false”. In this case, the creation of another authorisation on the payment will be forbidden and you will just have to authorise the payment using the link in the response.

If this header is set to true you will have to create manually an authorisation on the payment with the following request :

Use the values below in the request path to test this API:

| Payment service | Payment product | Payment Id |

|---|---|---|

| payments | sepa-credit-transfers | PAYMENT_ID_PATC_SCT |

| target-2-payments | PAYMENT_ID_PATC_T2P | |

| cross-border-credit-transfers | PAYMENT_ID_PATC_CBP | |

| bulk-payments | sepa-credit-transfers | PAYMENT_ID_BULK_PATC_SCT |

| target-2-payments | PAYMENT_ID_BULK_PATC_T2P | |

| cross-border-credit-transfers | PAYMENT_ID_BULK_PATC_CBP |

Here is an example of a body that you can use to test the request (single payment sepa credit transfers):

{

"instructedAmount": {

"currency": "EUR",

"amount": "42"

},

"debtorAccount": {

"iban": "FR6010096000303953573683E53"

},

"creditorAccount": {

"iban": "FR5730003000508771112157D50"

},

"creditorName": "DBL Inc.",

"requestedExecutionDate": "2030-01-01"

}

The authorisation workflow implements the BerlinGroup redirect scenario using OAuth2 SCA Protocol.

In order to test this redirect approach, the sandbox provides a graphical user interface in order to simulate all the possible SCA scenarios (Login fails, timeout, SCA rejected…) that are listed below:

| SCA scenario | Description |

|---|---|

| LOGIN_CANCEL | If the login phase was cancelled by the PSU |

| LOGIN_TIMEOUT | If the login phase encountered a timeout |

| LOGIN_OTHER_ERROR | If another error occurred during the login phase |

| LOGIN_REQUEST_REJECTED | If the login phase was rejected |

| BAD_PASSWORD_LOGIN | If an error occurred during the login phase with a bad password |

| UNKNOWN_LOGIN | If an error occurred during the login phase with an unknown login |

| SCA_OK | To get a successful authorisation |

| SCA_EXEMPTED | If the SCA phase was exempted |

| SCA_CANCEL | If the SCA phase was cancelled by the PSU |

| SCA_TIMEOUT | If the SCA phase encountered a timeout |

| SCA_OTHER_ERROR | If another error occurred during the SCA phase |

| SCA_NOK | If the SCA phase did not succeed |

| SCA_REQUEST_REJECTED | If the SCA phase was rejected |

| SCA_INTERNAL_ERROR | If an internal error occurred |

To access this graphical user interface you have to build your authorisation URI using the scaOAuth URL received in the response of the payment initialisation with the following parameters:

| URI parameter | Sandbox value | Comments |

|---|---|---|

| scope | PIS:PAYMENT_ID_RCVD_SCT | Must be set to this value on the Sandbox. On the production API, Must be set to this the consentId returned by the consent initialisation |

| client_id | VALID_CLIENT_ID | Must be set to this value on the Sandbox. On Production API, you must provide your NCA id |

| state | Any value | On Production API, this is a dynamical value that you have to set in order to prevent XSRF attacks |

| redirect_uri | Any URI value | On Production API, this corresponds to the URI where the OAuth2 server is redirecting the PSU after the authorization |

| code_challenge | Any value | On Production API, this corresponds to PKCE challenge according to cryptographic RFC 7636 (https://tools.ietf.org/html/rfc7636) and is used to prevent code injection attacks |

| response_type | code | Must be set to this value on the Sandbox and on Production API |

| code_challenge_method | S256 | On Production API this parameter is optionnal and corresponds to the code verifier transformation method ("S256" or "plain") |

Following these instructions, you should build the following URI for the sandbox:

This URI will redirect on a mocked page on which you can test the different redirect scenarios of the authorisation flow. All user flow will display an information page before redirecting the PSU to the redirect_uri (HTTP 302 response).

The different payment ids to use in the URL and in the “Consent-Id” header of these requests have this structure:

PAYMENT_ID_<payment service>_<payment status>_<payment product>

| Payment service | Payment status | Payment product |

|---|---|---|

| ∅ (payment) | ACCP (AcceptedCustomerProfile) | SCT (sepa credit transfer) |

| BULK (bulk payment) | ACSC (AcceptedSettlementCompleted) | CBP (cross border payment) |

| ACSP (AcceptedSettlementInProcess) | T2P (target 2 payment) | |

| ACTC (AcceptedTechnicalValidation) | ||

| ACWC (AcceptedWithChange) | ||

| ACWP (AcceptedWithoutPosting) | ||

| RCVD (Received) | ||

| PDNG (Pending) | ||

| RJCT (Rejected) | ||

| CANC (Cancelled) | ||

| PATC (PartiallyAcceptedTechnicalCorrect) |

Examples:

This request retrieves the list of the authorisations of the payment.

You can use the values below to test this API:

| Payment service | Payment product | Payment Id |

|---|---|---|

| payments | sepa-credit-transfers | PAYMENT_ID_PATC_SCT |

| target-2-payments | PAYMENT_ID_PATC_T2P | |

| cross-border-credit-transfers | PAYMENT_ID_PATC_CBP | |

| bulk-payments | sepa-credit-transfers | PAYMENT_ID_BULK_PATC_SCT |

| target-2-payments | PAYMENT_ID_BULK_PATC_T2P | |

| cross-border-credit-transfers | PAYMENT_ID_BULK_PATC_CBP |

| paymentAuthorisationId | Description |

|---|---|

| 11111111-1111-1111-1111-111111111111 | To retrieve an authorisation with the status “finalised” |

| 22222222-2222-2222-2222-222222222222 | To retrieve an authorisation with the status “received” |

| 33333333-3333-3333-3333-333333333333 | To retrieve an authorisation with the status “psuIdentified” |

| 44444444-4444-4444-4444-444444444444 | To retrieve an authorisation with the status “psuAuthenticated” |

| 55555555-5555-5555-5555-555555555555 | To retrieve an authorisation with the status “scaMethodSelected” |

| 66666666-6666-6666-6666-666666666666 | To retrieve a authorisation with the status “started” |

| 77777777-7777-7777-7777-777777777777 | To retrieve an authorisation with the status “failed” |

| 88888888-8888-8888-8888-888888888888 | To retrieve an authorisation with the status “exempted” |

For more details, please refer to the HowTo Cancel a Payment

Here are the different combinations that you can use in the URL of this request:

|

Payment service |

Payment product |

| payments | sepa-credit-transfers |

| cross-border-payments | |

| target2-payments | |

| bulk-payments | sepa-credit-transfers |

| cross-border-payments | |

| target2-payments |

For the payment Id parameter, here is its structure:

PAYMENT_ID_<payment service>_<payment status>_<payment product>

| Payment service | Payment status | Payment product |

|---|---|---|

| ∅ (payment) | ACCP (AcceptedCustomerProfile) | SCT (sepa credit transfer) |

| BULK (bulk payment) | ACSC (AcceptedSettlementCompleted) | CBP (cross border payment) |

| ACSP (AcceptedSettlementInProcess) | T2P (target 2 payment) | |

| ACTC (AcceptedTechnicalValidation) | ||

| ACWC (AcceptedWithChange) | ||

| ACWP (AcceptedWithoutPosting) | ||

| RCVD (Received) | ||

| PDNG (Pending) | ||

| RJCT (Rejected) | ||

| CANC (Cancelled) | ||

| PATC (PartiallyAcceptedTechnicalCorrect) |

Examples:

This request retrieves the list of the authorisations of the cancellation of a payment.

You can use the values below to test this API:

| Payment service | Payment product | Payment Id |

|---|---|---|

| payments | sepa-credit-transfers | PAYMENT_ID_PATC_SCT |

| target-2-payments | PAYMENT_ID_PATC_T2P | |

| cross-border-credit-transfers | PAYMENT_ID_PATC_CBP | |

| bulk-payments | sepa-credit-transfers | PAYMENT_ID_BULK_PATC_SCT |

| target-2-payments | PAYMENT_ID_BULK_PATC_T2P | |

| cross-border-credit-transfers | PAYMENT_ID_BULK_PATC_CBP |

| paymentAuthorisationId | Description |

|---|---|

| 11111111-1111-1111-1111-111111111111 | To retrieve an authorisation with the status “finalised” |

| 22222222-2222-2222-2222-222222222222 | To retrieve an authorisation with the status “received” |

| 33333333-3333-3333-3333-333333333333 | To retrieve an authorisation with the status “psuIdentified” |

| 44444444-4444-4444-4444-444444444444 | To retrieve an authorisation with the status “psuAuthenticated” |

| 55555555-5555-5555-5555-555555555555 | To retrieve an authorisation with the status “scaMethodSelected” |

| 66666666-6666-6666-6666-666666666666 | To retrieve a authorisation with the status “started” |

| 77777777-7777-7777-7777-777777777777 | To retrieve an authorisation with the status “failed” |

| 88888888-8888-8888-8888-888888888888 | To retrieve an authorisation with the status “exempted” |

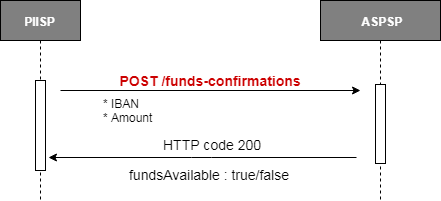

For more details, please refer to the HowTo Request a Confirmation of Funds

This request checks if funds are available for an account and an amount.

The values below allow you performing the different scenario cases:

| IBAN | Amount on the account | Overdraft of the account | Currency | PIIS Consent existence |

|---|---|---|---|---|

| FR8230066631856742938741993 | 150,02 | 100 | EUR | yes |

More details on how the APIs work, including sample queries, etc, are available in the Berlin Group's specifications. The above link redirects to the Implementation Guidelines, as well as the Berlin Group specifications in Open API 3.0 format.

The service is available through two sets of URLs, one for EU and the other one for UK customers. It is important to note that when one of the two URL sets is chosen then the workflow has always to follow the same URL set for everything.

A valid QWAC Certificate for PSD2 is required to access the Sandbox and Berlin Group API. The following conditions are verified:

A TPP can provide and use any number of valid certificates as long as the CA properties and organizationIdentifier stay the same. The old certificates are not revoked when a new valid certificate is presented by the TPP and can be kept in use until their expiration date is passed.

| SCA Approach | Supported | |

|---|---|---|

| Redirect OAuth 2.0 workflow | ✔ | |

| App redirection using App-to-App redirection based on deep linking workflow | ✖ | |

| Decoupled workflow | ✖ | |

| Embedded workflow | ✖ | |

| Services | Supported | |

|---|---|---|

| Support of multiple consents | ✔ | |

| Support of Signing Baskets | ✖ | |

| Support of Card Accounts Endpoints | ✖ | |

| Support display of Account ownerName and ownerNames | ✖ | |

| Support display of Account psuName | ✖ | |

| Owner name always delivered without taking into account the consent scope | ✖ | |

| Support of Trusted Beneficiaries endpoint | ✖ | |

| Support of Multilevel SCA Approach | ✖ | |

| Maximum Frequency Per Day Value Supported on Consent Request | 4 | |

| SCA Validity for a current consent | 180 days | |

| SCA Validity for a one-off consent | 20 min | |

| Consent establishment Timeout | 3 days | |

| Support of parameter withBalance on APIs | ✖ | |

| Supported Account Reference Identifiers | IBAN | ✔ |

| MaskedPan | ✖ | |

| BBAN | ✔ | |

| Consent scope | Dedicated consent (List of accounts) | ✔ |

| Dedicated consent - Support of ownerName in additionalInformation property | ✖ | |

| Dedicated consent - Support of trustedBeneficiaries in additionalInformation property | ✖ | |

| Global consent - availableAccounts = allAccounts | ✔ | |

| Global consent - availableAccountsWithBalance= allAccounts | ✔ | |

| Global consent - allPsd2= allAccounts | ✔ | |

| Global consent - availableAccounts = allAccountsWithOwnerName | ✖ | |

| Global consent - availableAccountsWithBalance= allAccountsWithOwnerName | ✖ | |

| Global consent - allPsd2= allAccountsWithOwnerName | ✖ | |

| Supported Access for MultiCurrency Accounts | ✖ | |

| Multicurrency level | Aggregation level | ✖ |

| Sub-account level | ✖ | |

| Aggregation & sub-account level | ✖ | |

| Balance Type | closingBooked | ✖ |

| expected | ✖ | |

| openingBooked | ✖ | |

| interimAvailable | ✔ | |

| interimBooked | ✖ | |

| forwardAvailable | ✖ | |

| Supported Transactions Query Parameters | bookingStatus = booked | ✔ |

| bookingStatus = pending | ✖ | |

| bookingStatus = both | ✖ | |

| bookingStatus = all to request all types of transactions (pending, booked and information) at once | ✖ | |

| dateFrom | ✔ | |

| dateTo | ✔ | |

| entryReferenceFrom | ✖ | |

| deltaList | ✖ | |

| Support of Standing orders endpoint (bookingStatus=information) | ✖ | |

| Supported optional transaction information (Standing Orders) | debtorName | ✖ |

| instructionIdentification | ✖ | |

| remittanceInformationUnstructuredArray | ✖ | |

| remittanceInformationStructuredArray | ✖ | |

| creditorAgent | ✖ | |

| debtorAgent | ✖ | |

| balanceAfterTransaction | ✖ | |

| Services | Supported | |

|---|---|---|

| Support of Signing Baskets | ✖ | |

| Payment initiation Timeout | 2 days | |

| Support of PIS without IBAN - Retrieval of debtor accounts with AIS flow | ✔ | |

| Selection of debtor account on CBS pages when payment submission without IBAN | ✖ | |

| Funds Availability on Payment Status Information (implicit FCS over PIS) | ✖ |

|

| Support of TPP-Rejection-NoFunds-Preferred Header | ✖ | |

| Support payment status notification (instant payment only) | ✖ | |

| Mandatory Authorisation on Payment Cancellation | ✖ | |

| Supported Access for MultiCurrency Accounts | ✖ | |

| Multicurrency level | Aggregation level | ✖ |

| Sub-account level | ✖ | |

| Aggregation & sub-account level | ✖ | |

| Support display of ownerNames in payment status request | ✖ | |

| Support display of psuName in payment status request and SCA status request | ✖ | |

Support of SEPA credit transfers |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✔ | ✖ | ✔ |

| Cancel | ✔ | ✖ | ✔ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✔ | ✖ | ✔ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✔ | ✖ | ✔ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✔ | ✖ | ✔ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✔ | ✖ | ✔ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✔ | ✖ | ✔ |

| remittanceInformationUnstructuredArray | ✔ | ✖ | ✔ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✔ | ✖ | ✔ |

| requestedExecutionTime | ✔ | ||

Support of crossborder payment |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✔ | ✖ | ✔ |

| Cancel | ✔ | ✖ | ✔ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✔ | ✖ | ✔ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✔ | ✖ | ✔ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✔ | ✖ | ✔ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✔ | ✖ | ✔ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✔ | ✖ | ✔ |

| remittanceInformationUnstructuredArray | ✔ | ✖ | ✔ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✔ | ✖ | ✔ |

| requestedExecutionTime | ✔ | ||

Identification management for crossborder payment |

Supported |

||

| IBAN | ✖ | ||

| IBAN + BIC + Country Code | ✔ | ||

| IBAN + BIC | ✖ | ||

| BBAN + BIC + Country Code | ✖ | ||

| BBAN + BIC | ✖ | ||

Support of Instant SEPA credit transfers |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✖ | ✖ | ✖ |

| Cancel | ✖ | ✖ | ✖ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✖ | ✖ | ✖ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✖ | ✖ | ✖ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✖ | ✖ | ✖ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✖ | ✖ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✖ | ✖ | ✖ |

| requestedExecutionTime | ✖ | ||

Support of Target2 payment |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✔ | ✖ | ✔ |

| Cancel | ✔ | ✖ | ✔ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✔ | ✖ | ✔ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✔ | ✖ | ✔ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✔ | ✖ | ✔ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✔ | ✖ | ✔ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✔ | ✖ | ✔ |

| remittanceInformationUnstructuredArray | ✔ | ✖ | ✔ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✔ | ✖ | ✔ |

| requestedExecutionTime | ✔ | ||

| Periodic payments options | Not supported | |

|---|---|---|

| Support of Day Of Execution | ✖ | |

| Supported Execution Rules | Following | ✖ |

| Preceding | ✖ | |

| Supported Frequencies | Daily | ✖ |

| Weekly | ✖ | |

| EveryTwoWeeks | ✖ | |

| Monthly | ✖ | |

| EveryTwoMonths | ✖ | |

| Quarterly | ✖ | |

| SemiAnnual | ✖ | |

| Annual | ✖ | |

| MonthlyVariable | ✖ | |

According to the Berlin Group Implementation guidelines, there can be different methods for the PSU to carry out its strong authentication. Ebury is supporting the following one(s):

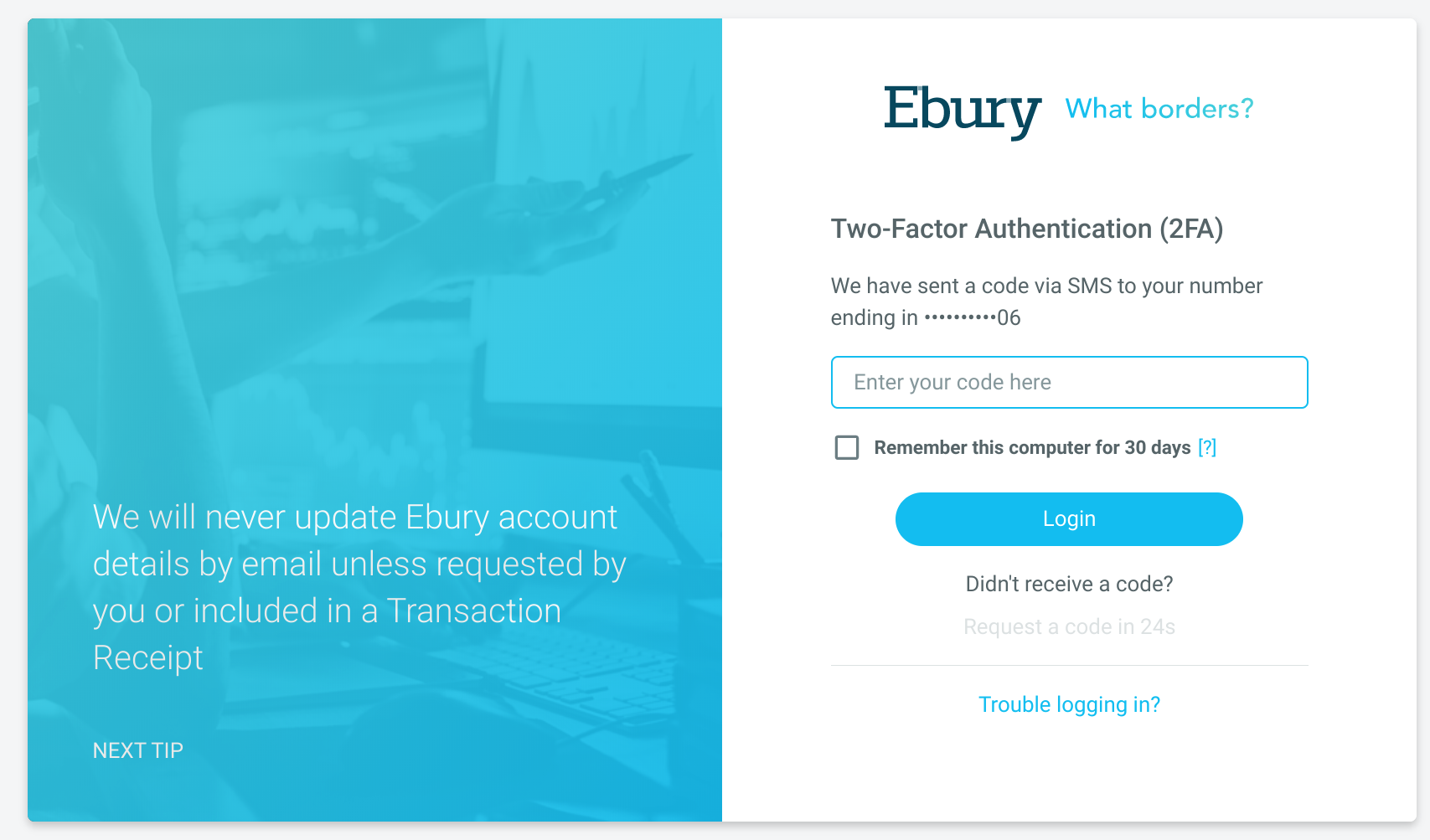

The PSU is redirected from the TPP interface to a web browser in order to perform her/his SCA.

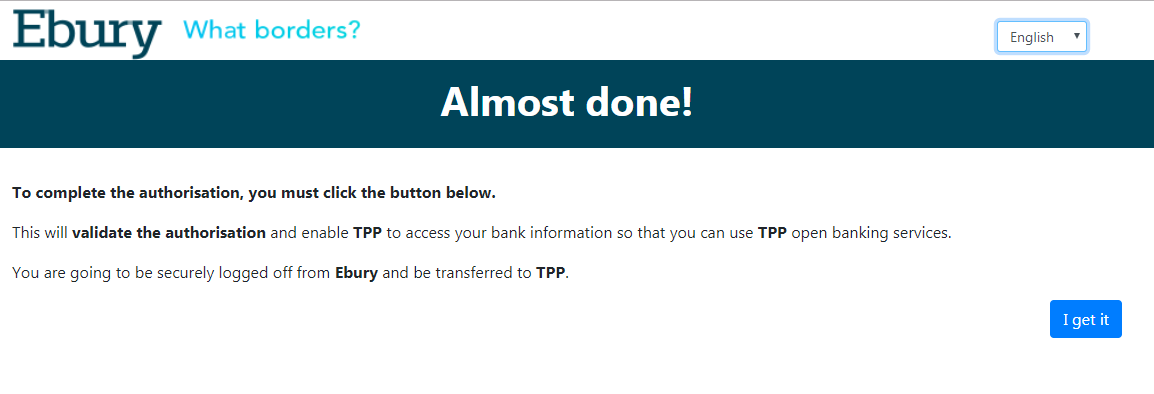

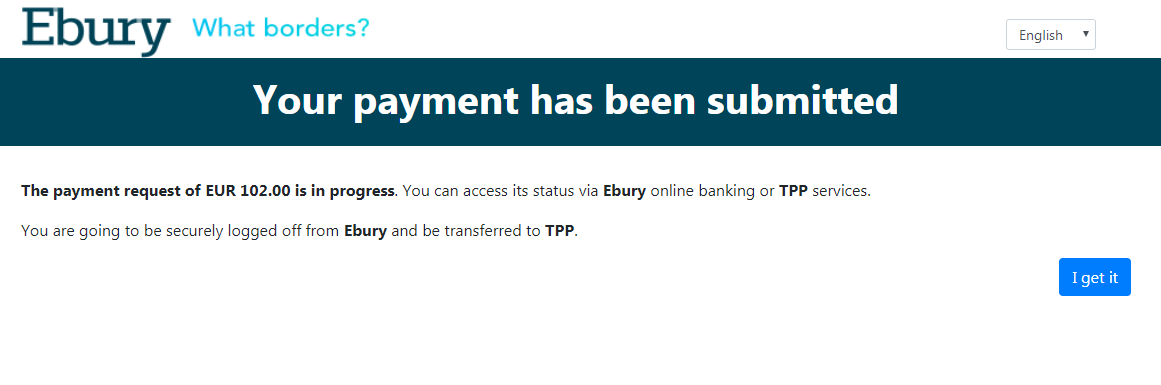

To carry out its strong authentication on the ASPSP side, the PSU will be redirected from the TPP APP through several pages within the workflow described below.

Before being redirected to the TPP App, the PSU will access a redirection screen with some context related to the given authorisation. This screen is slightly different for AIS and PIS.

Creates a confirmation of funds request at the ASPSP. Checks whether a specific amount is available at the time of the request on an account identified by its IBAN. A PIIS consent has to exist in order to perform this request.

For specific BerlinGroup Implementation on the Fund Confirmation Service, please refer to specific implementation How To.

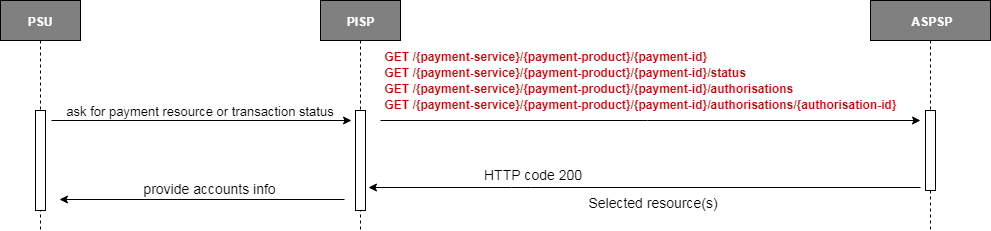

To access a payment resource or the status of a related transaction several endpoints are available. The APIs are listed below. All specifications of these APIs can be found on the API page of this developer portal.

Note that to access payment resources, you don't need to provide an access token in requests if the payment has been initiated through a redirect Oauth2 workflow

The TPP can retrieve the payment resource using the API above.

The TPP can retrieve the transaction status of a given payment using the API above.

TPP can retrieve the list of all the authorizations linked to the payment resource using the API above.

The TPP can retrieve the status of an authorization linked to the consent resource using the API above.

For specific BerlinGroup Implementation on the Payment Initiation Service, please refer to specific implementation How To.

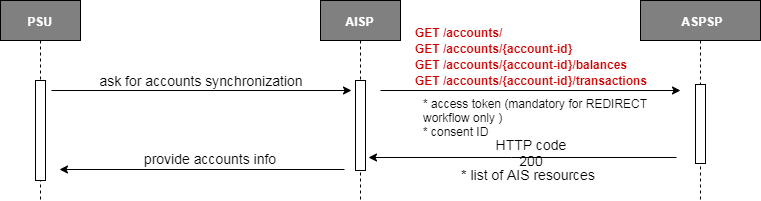

To access all AIS API, a valid consent established between the TPP, the PSU and the ASPSP is required. In addition, when TPP are using the REDIRECT workflow, they must also provide the access token related to the given consent. The APIs accessible with this consent are listed below. All specifications of these APIs can be found on the API page of this developer portal.

Returns all the accounts (at least payment accounts) that the ASPSP managed for the PSU.

Retrieve all the characteristics of a specific account Characteristics include - Balances (current, available) - Label - Account number - Type of the account.

Returns the balances linked to the account specified.

Returns the transactions linked to the account specified.

Retrieving transactions older than 90 days is authorised only if the consent is valid during 20 minutes after the SCA was performed.

In the case of a one-off consent, all accounts access are authorised within these 20 minutes.

In the case of a current consent, the access to the transactions prior to 90 days is restricted to the first request for the associated account after the SCA was performed.

If not all transactions can be returned in a single call, a pagination mechanism is included to manage the historical depth of transactions to return through a 'page' query parameter. Response body include navigation links for paginated account reports which allow redirection to first, next, previous or last page. By default the first page is indexed as 0.

TPP can access each AIS resources at a maximum of rolling 4 times period per day. For example:

The counter is not incremented when calling the same endpoint with a different page number within 15 minutes. However, in case of a second call further in the day on the endpoint with the same query parameters (page excluded), the incrementation is applied. For example:

For specific BerlinGroup Implementation on the Account Information Service, please refer to the specific implementation How To.

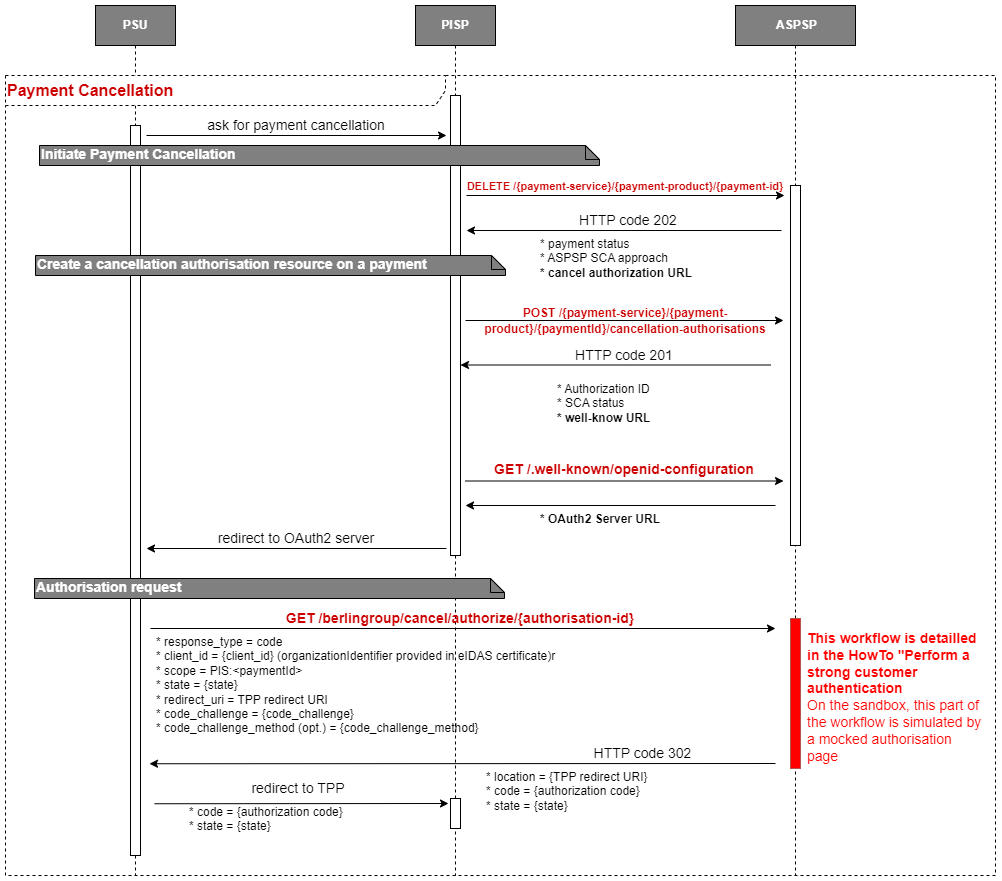

For the purpose of carrying out a payment cancellation with the XS2A APIs, it is necessary for the TPP to ask for the cancellation to the ASPSP.

In this approach, the PISP has to proceed with an OAuth2 authorization. The cancellation request is established and validated thanks to a redirection of the PSU towards the ASPSP Authentication platform.

See How to Perform a Strong Customer Authentication for details.

Asks for payment cancellation at the ASPSP for a given payment (giving id, service and product). Specificities for this API and available services and products are listed in the dedicated HowTo.

Creates an authorisation sub-resource of the payment resource for its cancellation and start the authorisation process.

Requests an authorisation from a PSU following the OAuth2 protocol. Details of the authentication workflow and user

interfaces are described in the dedicated HowTo section.

Our specificities regarding the OAuth2 protocol are

listed below.

response_type : code

code_challenge_method : S256

After successful authorisation, the user will be redirected to the redirect URI provided in the request with the following parameters :

For specific BerlinGroup Implementation on the Payment Initiation Service, please refer to specific implementation How To.

For the purpose of carrying out a payment initiation with the XS2A APIs, it is necessary to establish a consent between the TPP, the PSU and the ASPSP.

In this approach, the PISP has to proceed with an OAuth2 authorization. The consent is established and validated thanks to a redirection of the PSU towards the ASPSP Authentication platform.

See How to Perform a Strong Customer Authentication for details.

Note that to access payment resources, you don't need to provide an access token in requests if the payment has been initiated through a redirect Oauth2 workflow

Creates a payment resource at the ASPSP for a given payment service and product. Specificities for this API and available services and products are listed in the dedicated HowTo.

Create an authorisation sub-resource of the payment resource and start the authorisation process.

The usage of this access method is only necessary if the TPP has asked to start the authorisation process separately from the payment initiation (using the “TPP-Explicit-Authorisation-Preferred” Header).

Requests an authorisation from a PSU following the OAuth2 protocol. Details of the authentication workflow and user

interfaces are described in the dedicated HowTo section.

Our specificities regarding the OAuth2 protocol are listed below.

response_type : code

code_challenge_method : S256

After successful authorisation, the user will be redirected to the redirect URI provided in the request with the following parameters :

The PIS with no IBAN / Combined Service is a feature of the AIS consent. It allows a PISP to retrieve the list of account through an AIS request when it should not be able to do so.

Thanks to this feature, a PISP can offer a smooth PIS workflow where the PSU select a debtor IBAN from his/her account list instead of entering the IBAN manually.

TPPs with only the PISP role can only use the global consent scope availableAccounts: allAccounts.

An AIS Combined Service Consent can be one-off.

The property combinedServiceIndicator has to be set to true in the body of the request.

The combined service AIS consent is not supported for a multi authorization payment.

For specific BerlinGroup Implementation on the Payment Initiation Service, please refer to specific implementation How To.

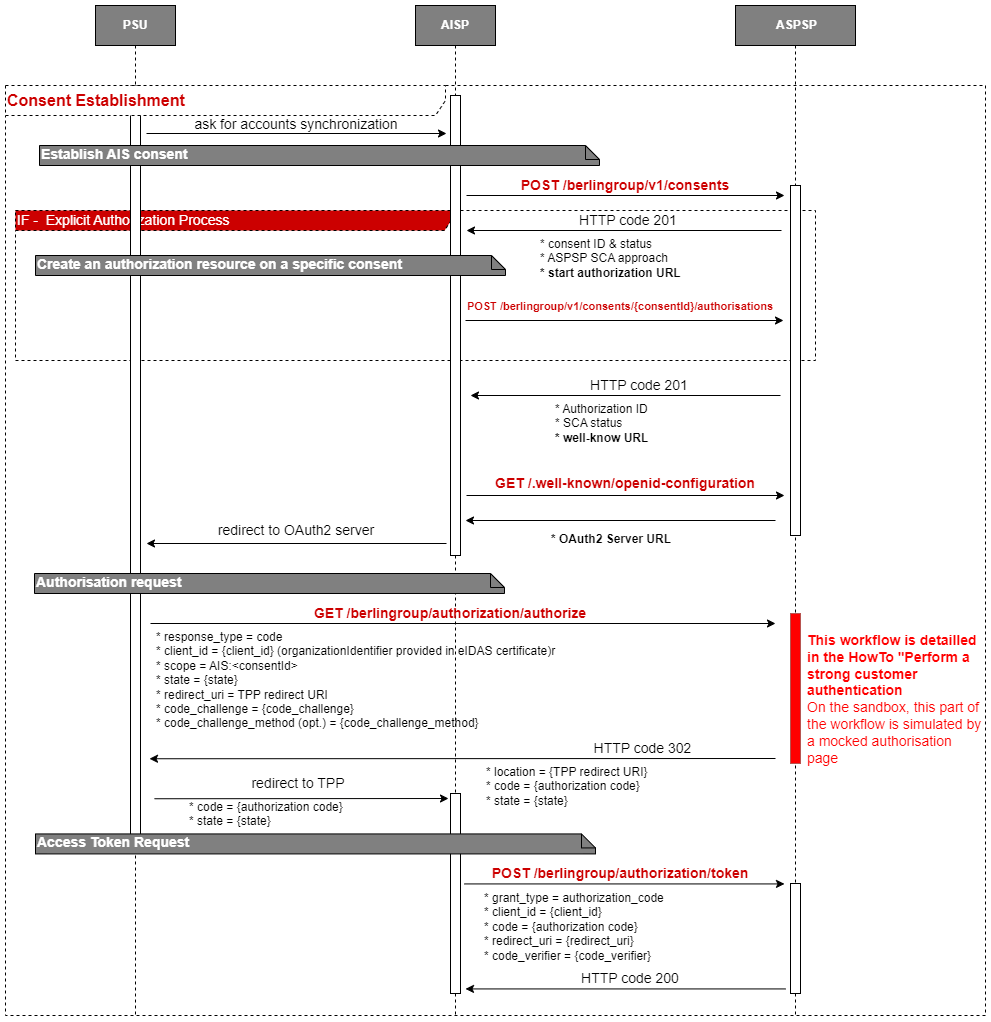

To access all AIS APIs, it is necessary to establish a consent between the TPP, the PSU and the ASPSP.

In this approach, the AISP has to proceed with an OAuth2 authorization in order to retrieve a time-limited access token.

This access token is mandatory to access all the AIS PSD2 APIs. It is associated to the consent established and validate thanks to a redirection of the PSU towards the ASPSP Authentication platform.

See How to Perform a Strong Customer Authentication for details.

Creates a consent resource at the ASPSP regarding access to accounts specified in this request. Specificities for this API are listed in the dedicated HowTo.

Creates an authorisation sub-resource of the consent resource and start the authorisation process.

The usage of this access method is only necessary if the TPP has asked to start the authorisation process separately from the consent establishment (using the “TPP-Explicit-Authorisation-Preferred” Header)

Requests an authorisation from a PSU following the OAuth2 protocol. Details of the authentication workflow and user

interfaces are described in the dedicated HowTo section.

Our specificities regarding the OAuth2 protocol are listed below.

response_type : code

code_challenge_method : S256

After successful authorisation, the user will be redirected to the redirect URI provided in the request with the following parameters :

Requests an access token using the authorization code retrieved from the PSU authorization. This Access Token can be refreshed. The duration of access token is 1 hour, and the duration of refresh token is 180 days.

The TPP can retrieve the consent resource using the API above.

The TPP can retrieve the consent's status using the API above.

The TPP can retrieve the list of all the autorisations linked to the consent resource using the API above.

The TPP can retrieve the status of an autorisation linked to the consent resource using the API above.

The TPP can use this API to terminate a consent.

Submitting a POST /consents request with the property recurringIndicator=false and frequencyPerDay=1 allows you to create a one-off consent.

In this particular case, all AIS accounts access are authorised for a period of 20 minutes

Ebury offers TPP a Multiple Consents Service that follows the Berlin Group NextgenPSD2 suggested implementation.

This service allows TPP to have multiple valid consents at the same time. This implies that TPPs may have different valid access token for the same PSU.

If this feature is used by the TPP, it is its responsibility to relate the consented data with the proper consent and access token.

The main impact of this service lies in the fact that, in case of a pre-existing and currently valid consent, a newly validated consent creation request will not automatically revoke the pre-existing consent. The TPP is then also responsible of revoking consents that are not used by the PSU anymore.

For specific BerlinGroup Implementation on the Account Information Service, please refer to the specific implementation How To.